Investment ideas that make sense going into 2025+

Preparing for a new era and political leadership in the United States

Recent Popular Posts

Book of the Week - Who Not How - Dan Sullivan & Dr. Benjamin Hardy

Welcome to The LineUp! Our weekly newsletter seeks to add value by engaging, connecting, and inspiring real estate operators, investors, and entrepreneurs. If you enjoy what you read, please like, share, and subscribe. Thank you for your support in growing this community! If you’d like to participate in our conversation join us on the Substack Chat here.

Going into 2025, there are compelling reasons to be optimistic about private industry and real estate investments. The takeover of the Trump administration from the prior administration means a return to pro-business policies, likely benefiting sectors across the board through deregulation and incentives. While opposing economic arguments could be made, historical precedence suggests that a pro-business environment typically fuels certain industries and asset classes, making now an ideal time to position for maximum returns.

Yield Curve Normalization and Economic Impact

Yield Curve Outlook: The yield curve is expected to continue normalizing and steepening, correcting the prolonged inversion seen over the past few years. As Federal Reserve policy aims to reduce short-term rates by 100-200 basis points, business activity should accelerate, even as the public sector reduces the positions added in recent years.

This restructuring should pave the way for net-positive job growth and an eventual GDP boost. The Federal Reserve Bank of New York notes that a normalized yield curve often correlates with increased economic stability and growth. But really investors just want to get paid for duration risk and the time value of their money in long dated (read 10-30Y) UST’s.

Impact on Real Estate Yields: As bond yields rise, real estate investments will face competitive pressure, which is historically typical. Investors in real estate assets from 2021-2023 may experience strain due to this yield adjustment, potentially driving market corrections and, in some cases, necessitating government intervention to stabilize sectors. According to National Bureau of Economic Research (NBER) studies, such cycles offer strategic investors the chance to acquire undervalued properties in resilient markets for meaningful long-term gains. We believe there will be “bumps” along the proverbial road and positioning for growth with an eye towards risk-management is especially warranted.

High-Growth Sectors to Watch

Data Centers and Supporting Infrastructure: Data centers remain essential to the backbone of the internet, cloud computing, and AI. According to CBRE Research, the sector's growth continues to outpace expectations as businesses rely increasingly on cloud and digital services. Investors in data center construction and operations are well-positioned to benefit as demand persists.

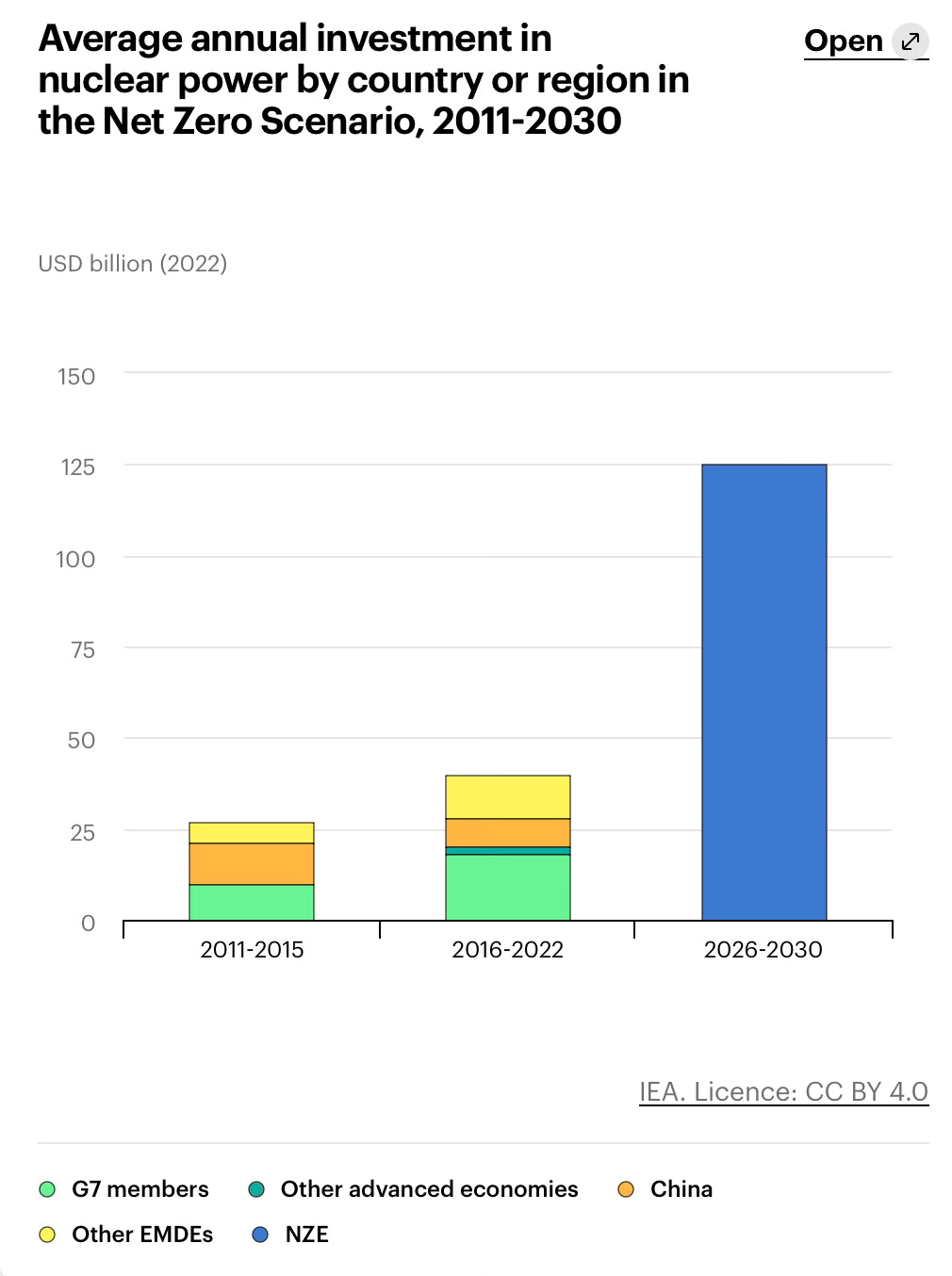

Energy (Nuclear, Electric Power, Oil, and Gas): The push for resilient energy infrastructure to support data centers and energy independence aligns with federal policy. International Energy Agency (IEA) reports anticipate that nuclear and gas infrastructure investments will play a pivotal role in addressing long-term energy needs, particularly as renewable solutions scale. Master Limited Partnerships (MLPs), offering tax advantages, are a favorable structure in this sector.

Crypto and Blockchain Technology: With growing mainstream adoption and regulatory maturation, crypto assets and blockchain-based companies could see continued growth. Fidelity Digital Assets and similar institutions expect institutional interest in blockchain technology to increase, particularly around use cases beyond cryptocurrency, such as supply chain management and digital contracts. Bitcoin remains an important leader in the crypto space. There is also talk about creating a Crypto Strategic Reserve.

Robotics and Automation: From defense applications to workforce automation, robotics represents a substantial growth opportunity. Boston Consulting Group (BCG) anticipates a $26 billion market by 2030 as companies leverage robotics to offset labor costs and enhance efficiency.

TSLA 0.00%↑ Tesla is an obvious choice for this investment theme right now. With the relationship between Trump and Musk, this could be extremely beneficial for Tesla stock. It has surged since the election. Finding the right entry points might make sense to getting into a longer term position.

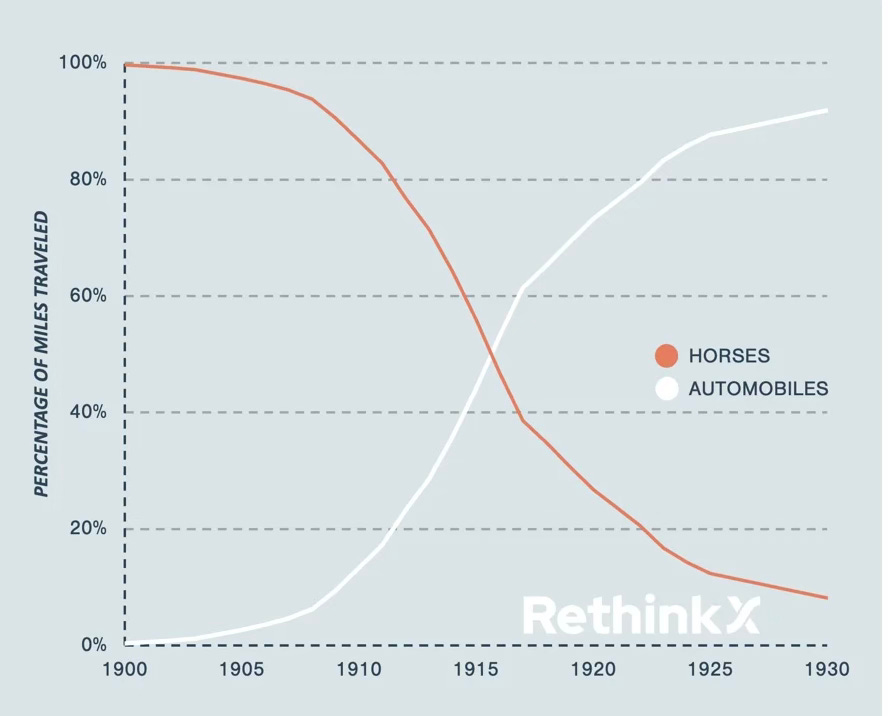

RethinkX believes we will see a major disruption in the labor force with robots impacting everything from job availability, to cheaper products, and improved profit margins. They relate the disruption to that of the automobile and the horse between 1907 and 1922 where the use of horses for transportation went from 95% of all transport to none. This is called the X-curve of disruption.

Education and Private Institutions: The new administration is proposing a Department of Education overhaul. It is unclear as to how this trend will play out. That being said, independent education firms would thrive amid disruptions in traditional schooling. EdSurge highlights that deregulation in education often fuels demand for alternative learning platforms, charter schools, and private consultancy, meeting the need for quality education outside federal oversight.

Space and Aerospace Ventures: Space-related businesses, particularly those tied to Mars exploration and other missions, stand to benefit from government contracts and private sector partnerships. NASA and other agencies project that the space industry will continue to scale, requiring extensive support from subcontractors and vendors, making this a promising frontier for investment.

https://www.iea.org/energy-system/electricity/nuclear-power#tracking

If you haven’t seen it this video showing Starship taking off, entering orbit, then returning and being caught is awesome. This might be the most inspirational video I’ve seen ever.

Cybersecurity and Defense Firms: In a national security-focused administration, cybersecurity and physical security remain essential. Gartner predicts global cybersecurity spending to grow as businesses and governments prioritize defenses against digital and physical threats. Trump’s priority of building a wall on the southern border will require a large scale investment in technology and physical construction.

Financial Sector: Deregulation could ease operational constraints for financial institutions, benefiting large and small firms alike. According to Deloitte, relaxed regulations reduce compliance costs, improving profitability margins and fueling growth. Why not give a look at larger banks and smaller private investment firms?

Real Estate Investment Focus Areas

Office Space: Despite being unpopular, the office sector is poised for a contrarian resurgence as companies reconsider physical space needs. A JLL report on the future of work highlights evolving office demand, especially in affordable acquisitions, which may offer lucrative entry points. Careful consideration of supply and demand trends will be required to manage risk, but the rewards could be very interesting.

Housing Market: The housing shortage remains pressing, and demand continues to outstrip supply. Freddie Mac emphasizes that even with high mortgage rates, demand for affordable housing persists, making the right investments in residential real estate especially attractive.

Urban and Inner-Ring Suburban Infill: High-demand markets with supply constraints are ideal for urban infill projects. According to Urban Land Institute (ULI), well-located properties in these areas consistently outperform, making them a solid choice for capital growth.

Opportunity Zones: Expectation remains strong for the continuation or even expansion of the Opportunity Zone program. Economic Innovation Group (EIG) highlights Opportunity Zones as critical for promoting investment in underserved areas, potentially unlocking significant tax advantages and long-term growth for investors. DM me if you are interested in learning more.

In Conclusion

These sectors and strategies are not exhaustive but represent some of the most promising opportunities as we enter 2025.

Each area offers specific advantages aligned with anticipated regulatory and economic conditions.

Best of luck with your investments in 2025!

Cheers,

John

Important!: These are just some ideas from an experienced markets investor. Please conduct your own diligence and consult with financial advisors to ensure alignment with individual financial goals. This post is not financial advice and not meant to be construed as such.

Thank you for reading The Lineup. Do you have real estate, built-environment entrepreneurship or placemaking topic you'd like to see us cover in an upcoming issue? We'd love to hear from you! We are open to media partnerships. Reach out to us at info@pughmgmt.com. And don't forget to like, share, and subscribe!

What We Are Reading This Week

WSJ - Real Estate Scions Are Breaking a Cardinal Rule - Never Sell

The Real Deal - Discounted offer of $60/SF for distressed Loop office deal

This post is sponsored by Pugh Investment Partners. To learn more, reach out to us at contactus@pugh.investments or click this link to our website.