Welcome to The LineUp! Our weekly newsletter seeks to add value by engaging, connecting, and inspiring real estate operators, investors, and entrepreneurs. If you enjoy what you read, please like, share, and subscribe. Thank you for your support in growing this community!

First things first, I have to say I’m definitely a perma-bull. Meaning I’m an optimist who is always looking for ways to capitalize on investment trends. That being said….

History has a way of repeating itself and today reminds me of a few downturns I’ve experienced from my time on Wall Street (2001) and real estate development/investment (2007/08). The following elements remind me of those times…

High levels of economic uncertainty - interest rates are volatile, sentiment is down, and geopolitical uncertainty abounds.

Financing is difficult to attain - Banks don’t want to lend on real estate investments or over-extend themselves. Banks are in balance sheet clean-up mode today due to many having bad loans on their books they have yet to recognize.

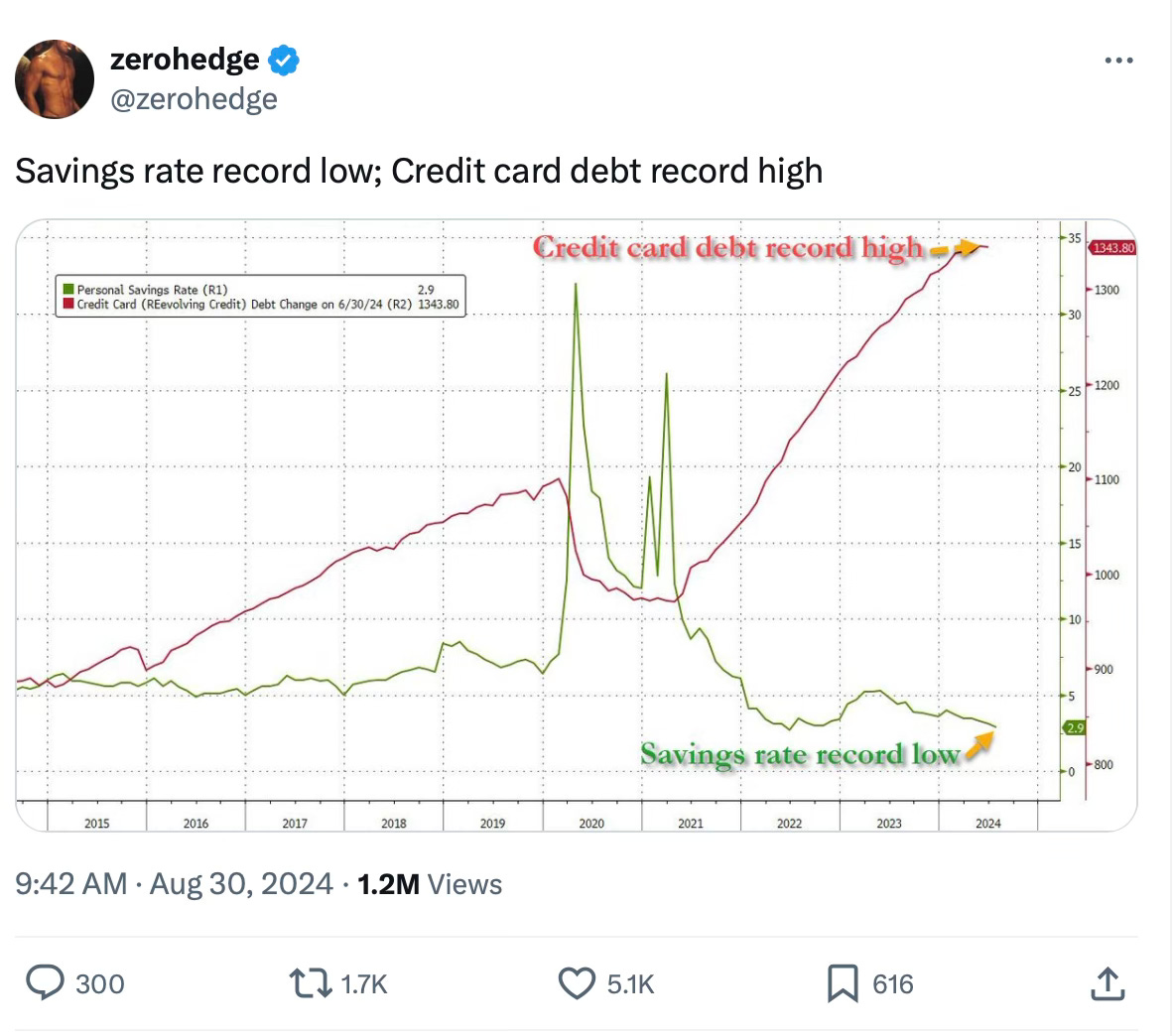

Consumers under pressure - In the U.S., two major indicators of consumer stress are setting records: credit card debt is at an all-time high, and personal savings rates are at an all-time low (see source below).

The big question is how the economy will react to the Federal Reserve systematically cutting the Fed Funds Rate to continue its attempt at a “soft landing.”

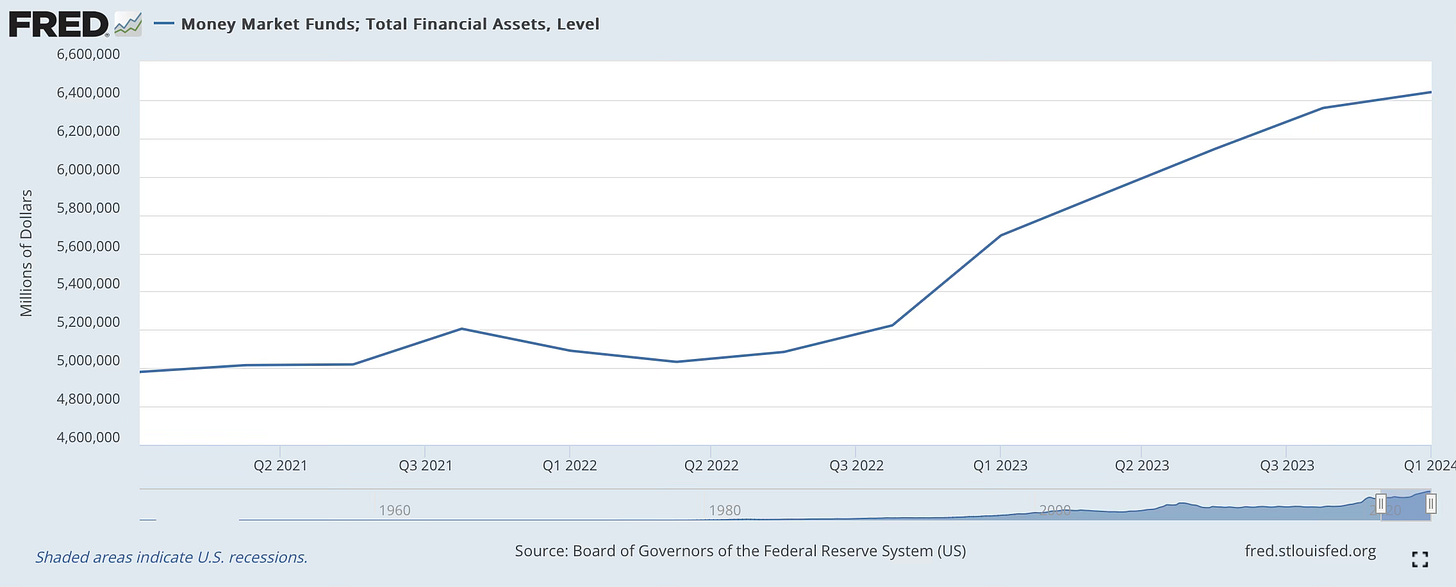

Many are in wait-and-see mode, looking for safety, with short-term yields. This has driven money market funds to reach all time highs and many players hiding out in short-term notes.

This wait-and-see moment creates opportunities for those willing to look hard enough for real value. We explore a few of those in a moment, but first, if U.S. politicians refuse to rein in the Federal government’s spending, which they are loathe to do, go or stay long gold. If you bought it in 2005, you’d be up ~400% today.

Right now, U.S. consumer savings rates are at record lows, while credit card debt is at record highs. The link is here from Zerohedge. This, along with large flows into money market funds, indicates a risk-off economy in the near and mid-term.

Since we can’t always hide in U.S. Treasuries and money market funds, what is an investor to do?

Investment themes we believe in today:

The AI Revolution - The use of AI in our professional lives is becoming ubiquitous. In the most recent McKinsey Global Survey on AI, 65% of respondents report their organizations are regularly using AI. See the link here.

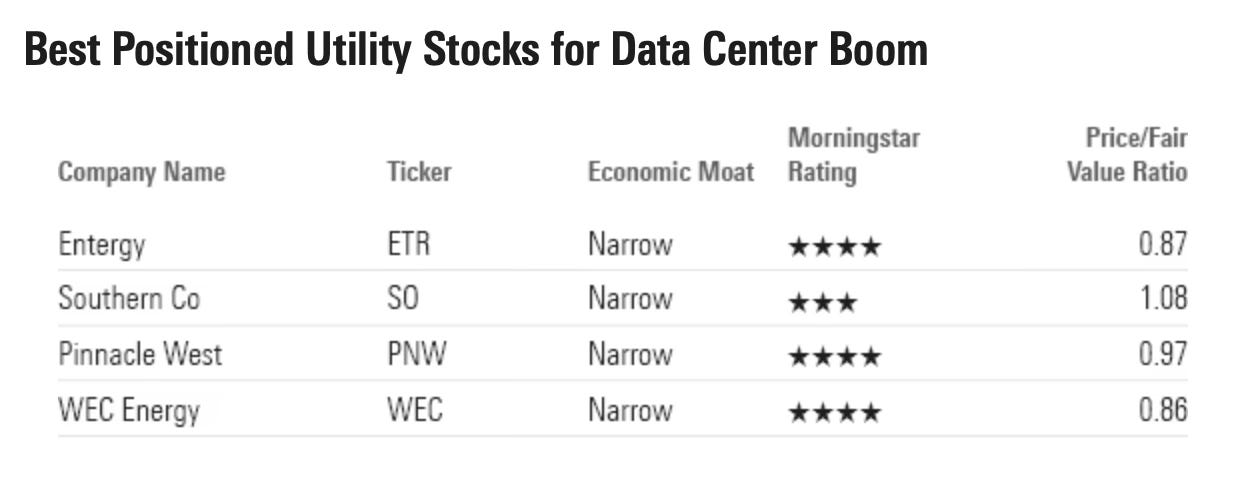

You can invest directly in companies like Google, Microsoft, or Apple which are integrating AI into their platforms. Or you could invest in stocks like AMD and Nvidia, who are providing the chips for the AI computing required by AI. Or you could take a less direct route and invest in the required utility infrastructure. Morningstar recommends these stocks…Entergy (ETR), Southern Co (SO), Pinnacle West (PNW), and WEC Energy (WEC).

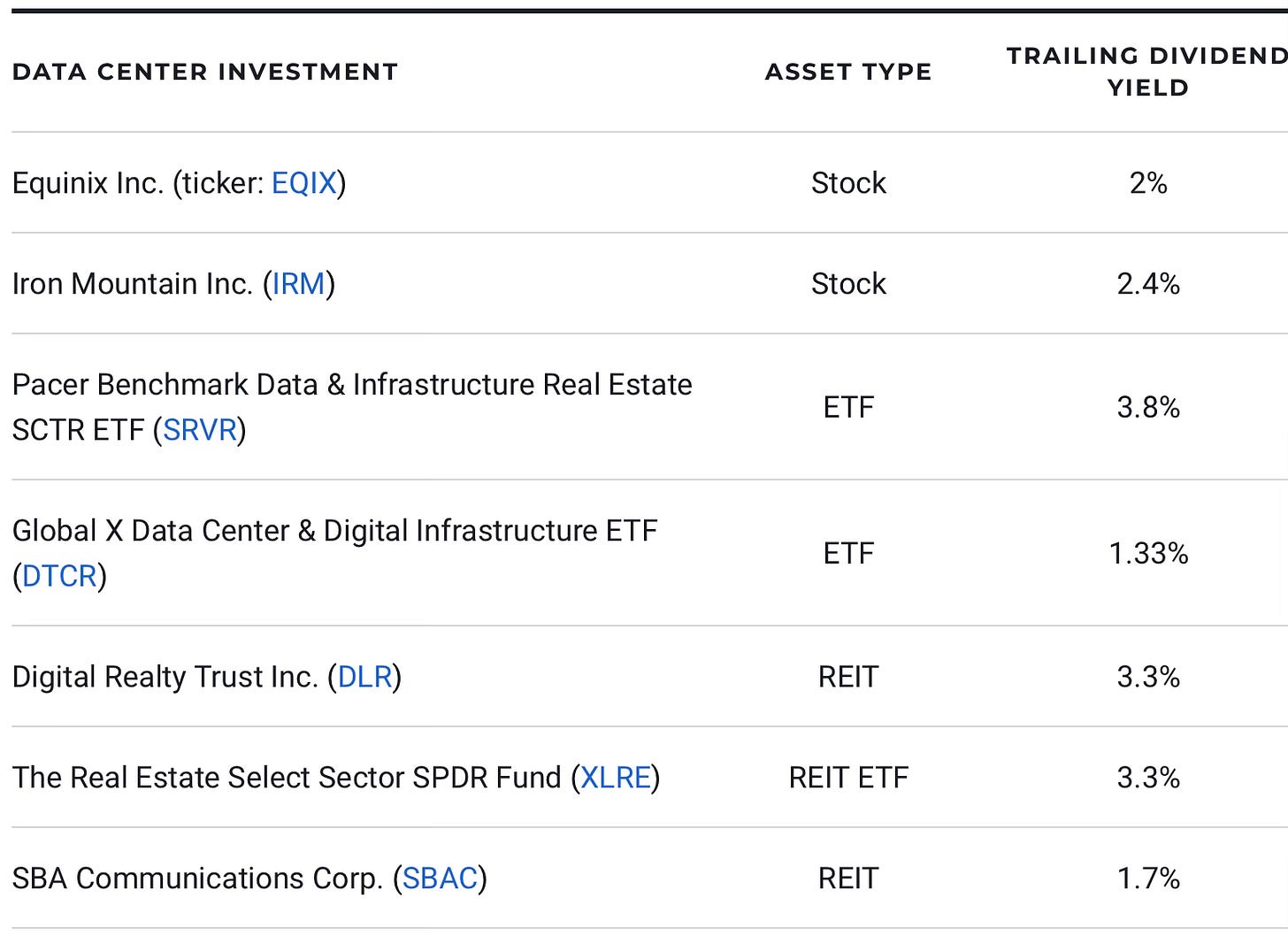

Data Centers for Days - As noted above AI is driving demand for data centers. Data Center development is surging as CapEx spending in the space soars. A recent news report notes Meta’s data center electricity consumption is up 34% year-over-year, with an almost 100% increase in usage in that time for their leased spaces. The utility stocks above are good options. And per US News, below is a wider variety of real estate stocks that can give you exposure to the data center space.

Multigenerational Housing—The government is not going to solve housing affordability. You may or may not agree with this statement. I'm sorry, not sorry. People have to live somewhere, so they will double up, not move out, and live with their aging parents.

According to the Pew Research Center the shared multigenerational living arrangements has more than doubled rising to 18% of the total population. How can you play this investment trend? Find developers who are focusing on it. Someone I have come across that is all in on this theme is Scott Choppin. Check him out; he’s based in California, and he’s been successfully building these types of homes for years.

Luxury (Baby Boomer) Storage - The Baby Boomers are still retiring with money to spend on luxuries, such as man caves, sports cars, and boats/yachts. Where will they keep all these toys? They have to go somewhere.

According to Google Trends, interest in “Luxury storage” has more than doubled in the past three years. How do you get involved with this trend? I don’t know. Figure it out and invite me to invest. Below is an example of a successful garage and track community in Tampa, Motor Enclave.

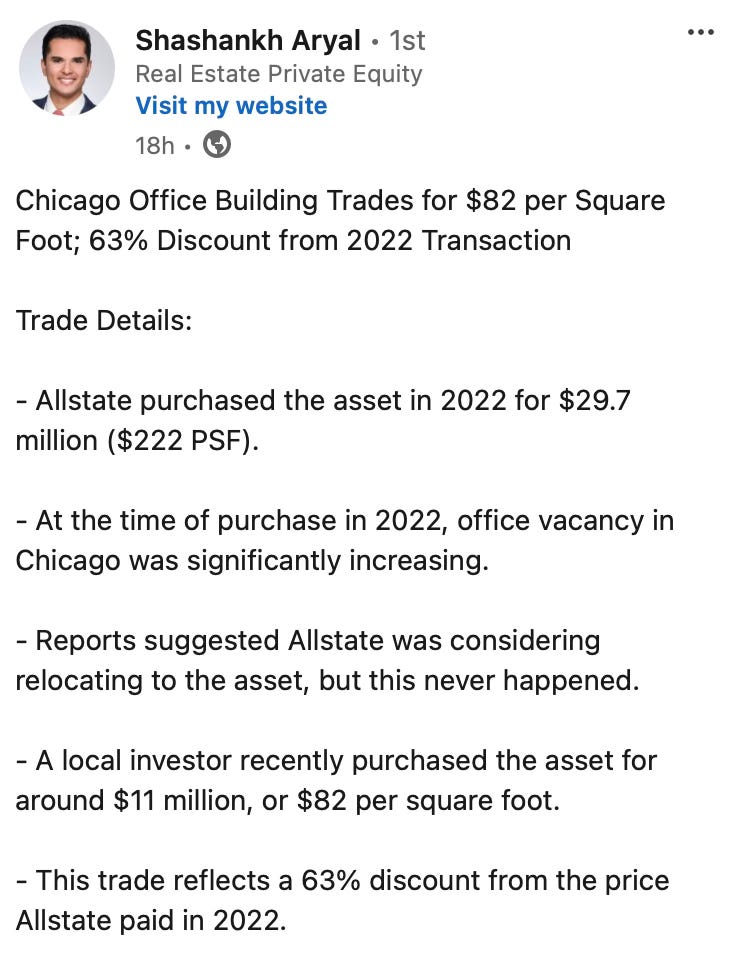

Distressed Real Assets - Buying up distressed assets in real estate will likely generate outsized returns over the next 10+ year business cycle. Many asset classes, such as offices, are selling at 1/2 or less of replacement cost. The office market is changing and someone has to figure it out.

Other areas of distress that are emerging are in the multifamily market where some owners over leveraged properties or they bought at peak prices in ‘20/’21/’22 and they cannot cover their Debt Service Coverage Ratios (DSCRs). If you’re willing to assemble a team and get your hands dirty this could be a great long-term trend. This is something I’m working on. If you’re interested in investing, or possible partnering, let me know.

Below is an example of the discount deals are trading at. Follow Shashankh Aryal on LinkedIn if you want to follow along in this space.

So I just shared some, as my son would say, “banger” investment ideas with you. Now it’s your turn. Go find something to invest in and tell me about it!

Cheers, John

What I’m Reading This Week (Books Only Edition)

Never Enough: From Barista to Billionaire by Andrew Wilkinson

The Wheel of Time: Book Seven Crown of Swords by Robert Jordan

Thank to our sponsors Pugh Management! Pugh Management invests in and develops real estate in New England and Central Florida. Contact us today to learn more at info@pughmgmt.com.

Very informative post with plenty of food for thought!

Distressed angle is certainly an interesting one coming up..!