Today's Distress in Real Estate Driven By Aggressive Assumptions

3 Areas in Your Pro Forma to Consider to Avoid Common Deal Pitfalls

Welcome to The LineUp! Our weekly newsletter seeks to add value by engaging, connecting, and inspiring real estate operators and entrepreneurs. If you enjoy what you read, please like, share, and subscribe. Thank you for your support in growing this community!

Yesterday a friend and I were discussing the market. He told me the development company he works for is pursuing new projects. Then he asked me what I am up to… and I told him I am extremely cautious right now. It’s so hard to determine where interest & cap rates will be in 2-3 years. Why would I make a big bet today?

That conversation and all the headlines about deals that are getting sold at massive discounts or in need of rescue capital led to this post.

Just a heads up on this topic

regularly shares on LinkedIn the latest deals that are underwater or have recently sold at big discounts. He is a good follow, I suggest you check him out on LinkedIn or here on Substack.So this week we review the most important assumptions in a project and ways we can mitigate some of the risks.

When we begin the underwriting process for a deal we gather data and do our research. There are things we know from previous projects, such as construction costs or the cost of permitting based on the anticipated length and type of approvals process.

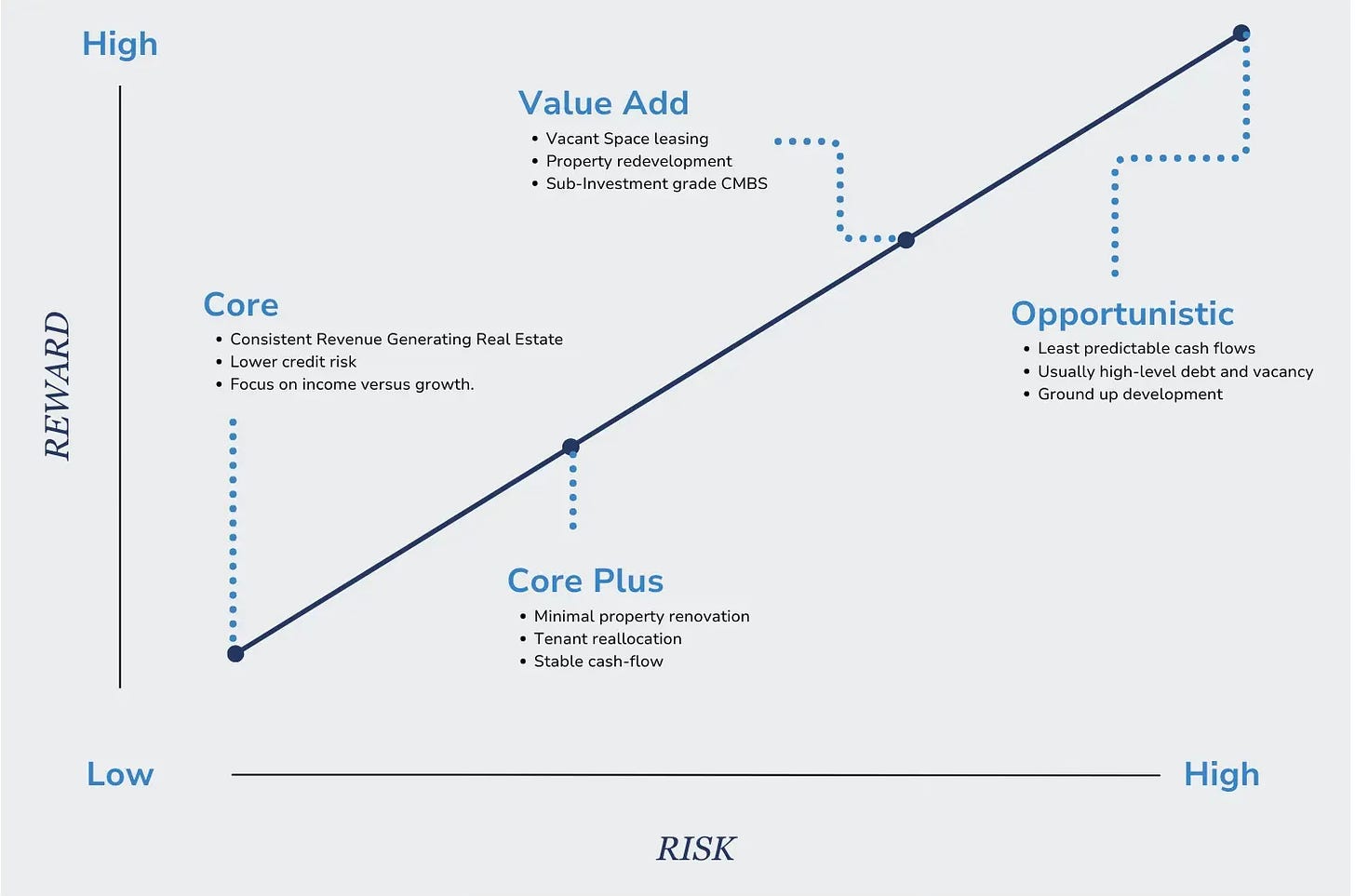

Whenever you underwrite a development deal you absolutely have to know your numbers and know your business model. But on certain elements you need to make assumptions. And the question we must ask ourselves over and over again is, “Are my assumptions reasonable?”

If you miss one even one of these assumptions, you may very well blow-up the returns on your project.

In 2024 this has happened again and again on deals originated in the 2020-2022 era delivering today. Then there are the deals never were not refinanced in 2023 and had maturities extended. Either way it’s a mess out there.

Let’s dig in to the most important pro forma assumptions for your latest projects.

Project Contingencies

Many real estate developers are learning all about project budget contingencies the hard way right now. A contingency is the amount of money as a percentage of the total budgeted cost held for overruns. These are typically for construction costs, financing, and soft costs. These numbers may vary from 2%-10%+ of the expense depending on the market, the budget item, and the Sponsor’s (GP) experience with the product type.

A good example about the importance of contingencies is a friend built an urban, last-mile warehouse last year. The $45,000,000 project came in under budget and on-time. All good news. As a result of proper management there was unspent contingency left.

So the building is complete in shell condition and awaiting tenant fit out. Leasing has been ongoing for 8 months. The right tenant has yet to surface and sign a lease. So the budget was correct for the construction project and the contingency held was appropriate, but if it isn’t leased in the near term, it may burn the contingency off. This is a combination of the leasing going slower than expected and to much higher than anticipated interest rates. Both add up to a monthly debt service payment that is draining the coffers of the project budget.

Unfortunately this may result in lower than anticipated returns.

When markets move significantly contingencies can be inappropriately small. All developers know this and proceed with caution.

If we had to make a contingency big enough to cover every single potential cost, we would never be able to finance and start a new project. So we all must be as conservative as we can while also exercising the proper amount of care and professionalism required.

As I think you can tell, this is a tricky topic and you have to make an educated guess.

Debt Service Coverage Ratio

An important ratio in real estate development is the DSCR, Debt Service Coverage Ratio or the Annual NOI/Debt Service. DSCR serves as a reference point for banks/lenders in loan covenants. This reference point ensures the property is being operated professionally so the bank/lender can eventually get their money back.

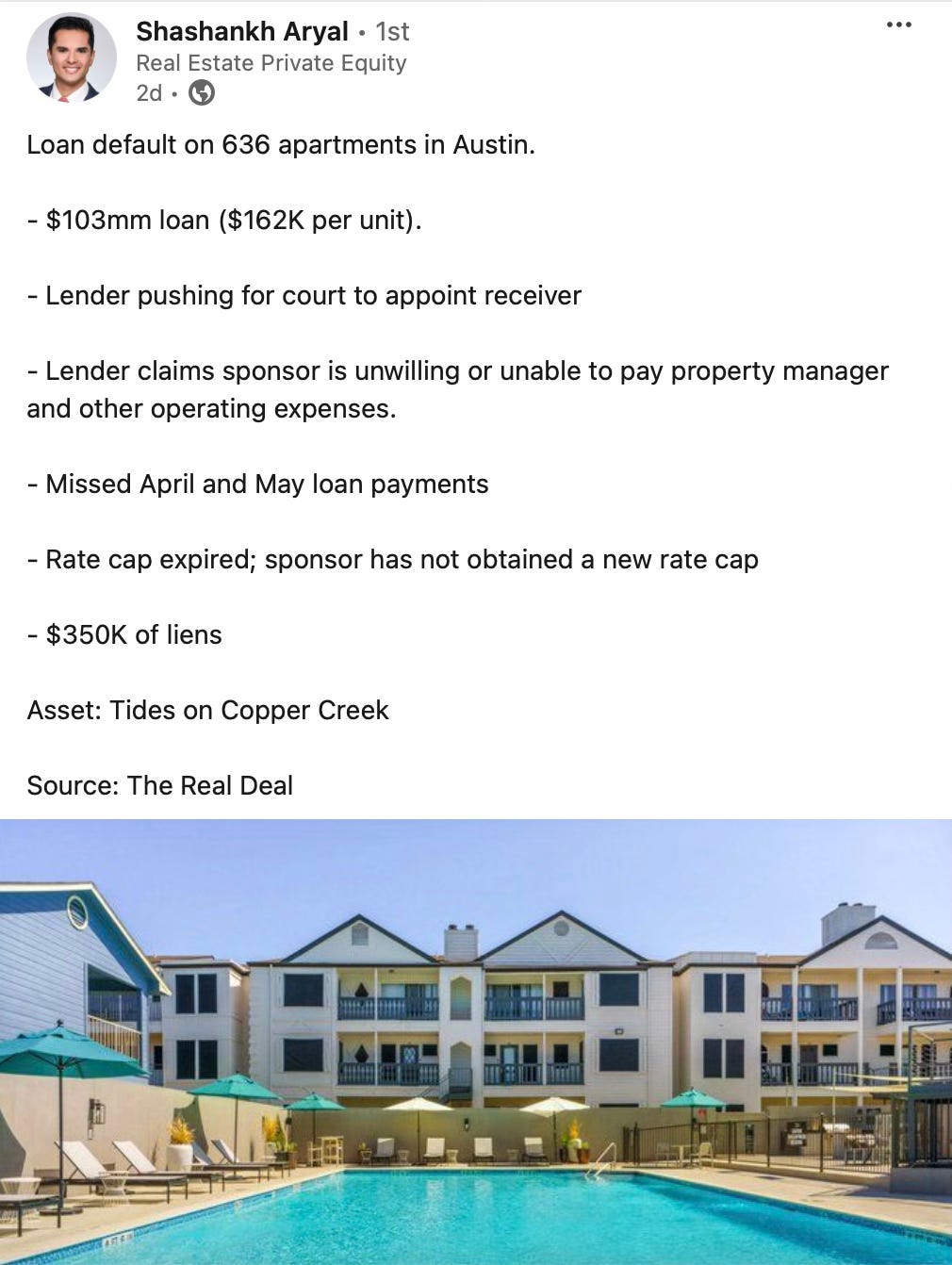

In many of the distressed deals today the DSCR ratio is not being met or maintained by the project sponsors.

A typical stabilized DSCR is 1.25 for permanent and construction loans. To achieve a stabilized DSCR a few things have to happen.

The most obvious is your rents need to come in where you assumed they would, as well as the operating expenses. NOI = Rents less taxes, operating expenses, and insurance, so this is the numerator of the ratio. From 2020-2022 rents grew, then plateaued and are now falling in many municipalities. Operating expenses, insurance, and taxes have generally gone up on everything, everywhere. So today both of these changes serve to decrease the numerator of the ratio. Not good for property owners and investors.

In the denominator, the debt service must be anticipated in either a conservative or a more aggressive manner. If for example the Federal Reserve raises the overnight lending rate by 5.25% in 18 months, as happened recently, the denominator might be much larger than expected and achieving your DSCR might impossible.

The aggressive Fed tightening has reset the cost of capital for debt and greatly impacted DSCR’s. Is this spurring many of the defaults and distress in CRE today? Or is it inappropriately aggressive assumptions?

I’d say it is a bit of both. The move by the Fed has been historic. When you couple that with aggressive dealmaking in the 2017-2022 era you have a volatile situation. See the front page of today’s The Real Deal below.

Exit Cap Rates

Finally we come to exit cap rates, which are always a crystal ball scenario when underwriting any real estate development project. Most developers use what the current cap rates are as the base for their exit cap rate.

The exit cap is important because it provides the basis for the IRR, you take the 12-month Forward NOI/Exit Cap Rate at the end of your anticipated hold period and that gives you the sale price. The sale price is typically the major capital event in your series of cash flows.

So if you use the market cap rate for your projected exit and cap rates move up by 100 basis points…you may very well go from having a profitable deal, to one that is breaking even. Whenever we underwrite deals we try to be a bit more conservative and include contingencies in our budget, but also use a sensitivity table to consider how other potential outcomes might impact returns.

Cap rates are important, we triangulate the exit cap rates through a few sources typically recent transactions and broker reports/conversations, then make any minor adjustments (25-50 bps) to the exit cap rate based on our perception of the direction of interest rates and the market.

Unfortunately today with a lack of direction to markets, projecting an exit cap rate with confidence is a challenge.

Many people in the market, based off the Fed’s projections, anticipated interest rate cuts starting in March, then June, then September, now maybe later. If the Fed cuts interest rates later this year and more (100 bps?) next year, the economy and real estate prices could stabilize, but not until they clearly stop hiking.

The cost of capital has become extremely expensive over the past 18 months. The impact of this change on real estate values has not been as strong as one might anticipate. But as you can see from the headlines of the Real Deal, it’s getting there.

Cheers, John

Thank you for reading The Lineup. Do you have a real estate development topic you'd like to see us cover in an upcoming issue? We'd love the feedback! Let us know at info@pughmgmt.com And don't forget to like, share, and subscribe! We appreciate you!!

Thank you to our sponsors Pugh Management! Pugh Management provides advisory services and development management for ultra-high net worth individuals and family offices. Contact us today to learn more at info@pughmgmt.com

What We Are Reading This Week

The Promote - Wells Fargo’s Proptech Misadventure with Bilt and Ankara Jain

NEREJ - Related Beal Closes on financing for Innovation Square Phase III development

Update: Celtics win the 2024 NBA Finals!!!!! More to come next week.

The NBA Finals took an unexpected turn on Saturday night with the Mavericks blowing out the Celtics by 38 points, 122-84. The game was never close and the Mav’s ran the score up from the get-go. Dallas is a team with some great leaders but I’d be hard pressed to believe they will come back from 3-0 down to beat the Celtics. My pick is Celtics win in Game 5 at home in the Garden.

The NBA Draft is next week on 6/26-6/27. Who will get picked first? It seems a Frenchman is expected to take the top spot. His name is Alexandre Sarr and he’s 7’0” young man who most recently played in Australia professionally. His brother plays for the OKC Thunder. We shall see next week!