Where Smart Capital Is Going Now: A Mid-Year Field Guide for Investors and Operators

How capital is flowing in real assets — and what deals are getting funded.

Recent Popular Posts

📍 Setting the Stage

As we reach the midpoint of 2025, family offices are sharpening their real estate strategies. Real estate is no longer viewed simply as a hedge—it’s re-emerging as a cornerstone allocation. But capital isn’t moving indiscriminately. Deployments are more curated, more structured, and increasingly directed toward operators who’ve demonstrated full-cycle success.

In the conversations I’m having, there’s clarity: capital is moving, but only into strategies grounded in alignment, downside protection, and reliable income.

🔎 What the Data Is Telling Us

📊 Strategic Allocations Are Shifting

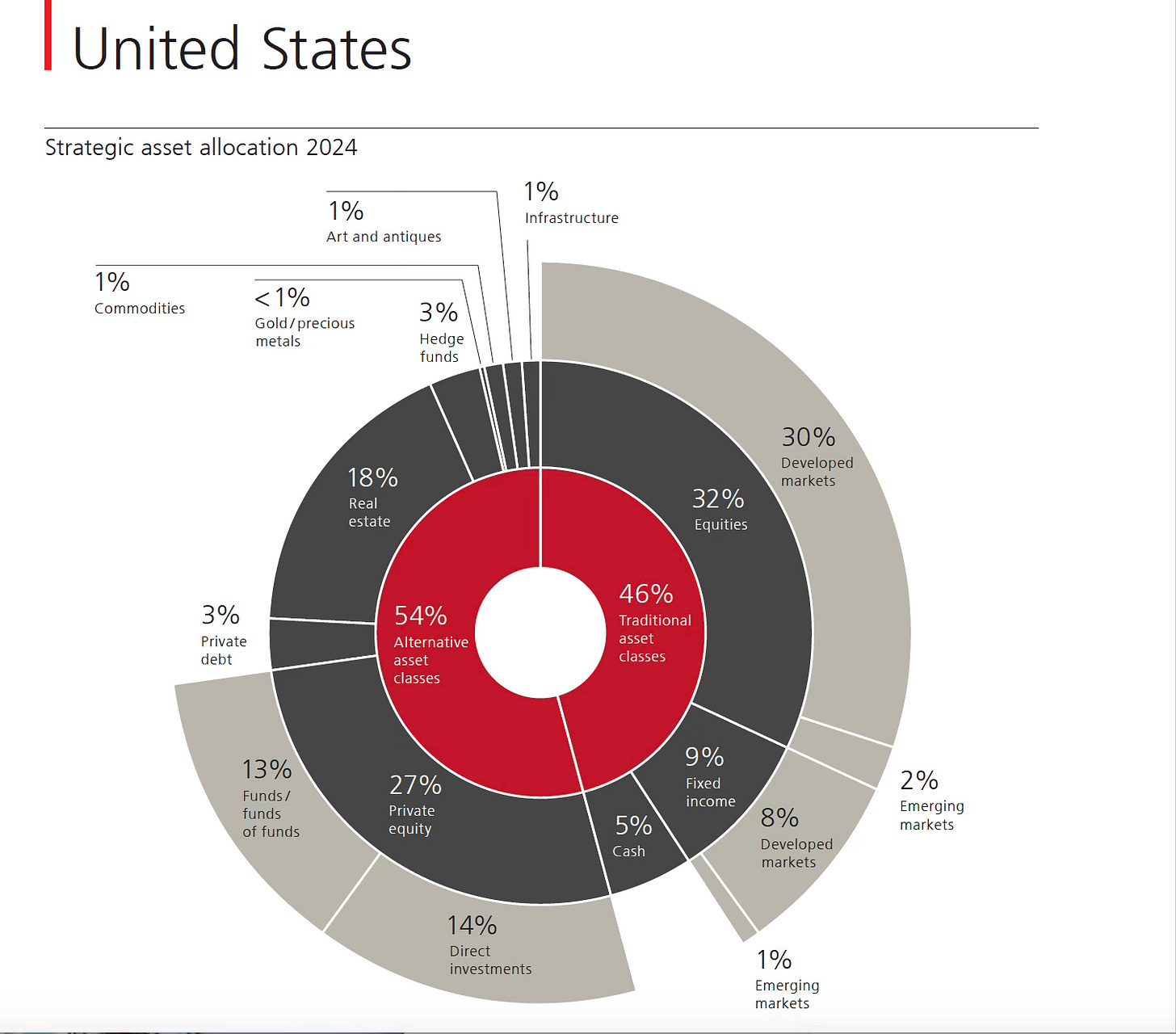

UBS: U.S. family office real estate allocations have reached 18%—the highest globally. See chart below.

29% of family offices plan to increase exposure to real estate over the next five years.

Private debt allocations have doubled, often structured into real estate transactions as preferred equity or senior positions.

📊 Family Offices Want Control

60% of real estate allocations are now deployed via co-investments (PwC).

BNY Mellon (June 2025): Over half of family offices expect to increase real estate allocations in the second half of the year, citing inflation hedging and the search for durable yield.

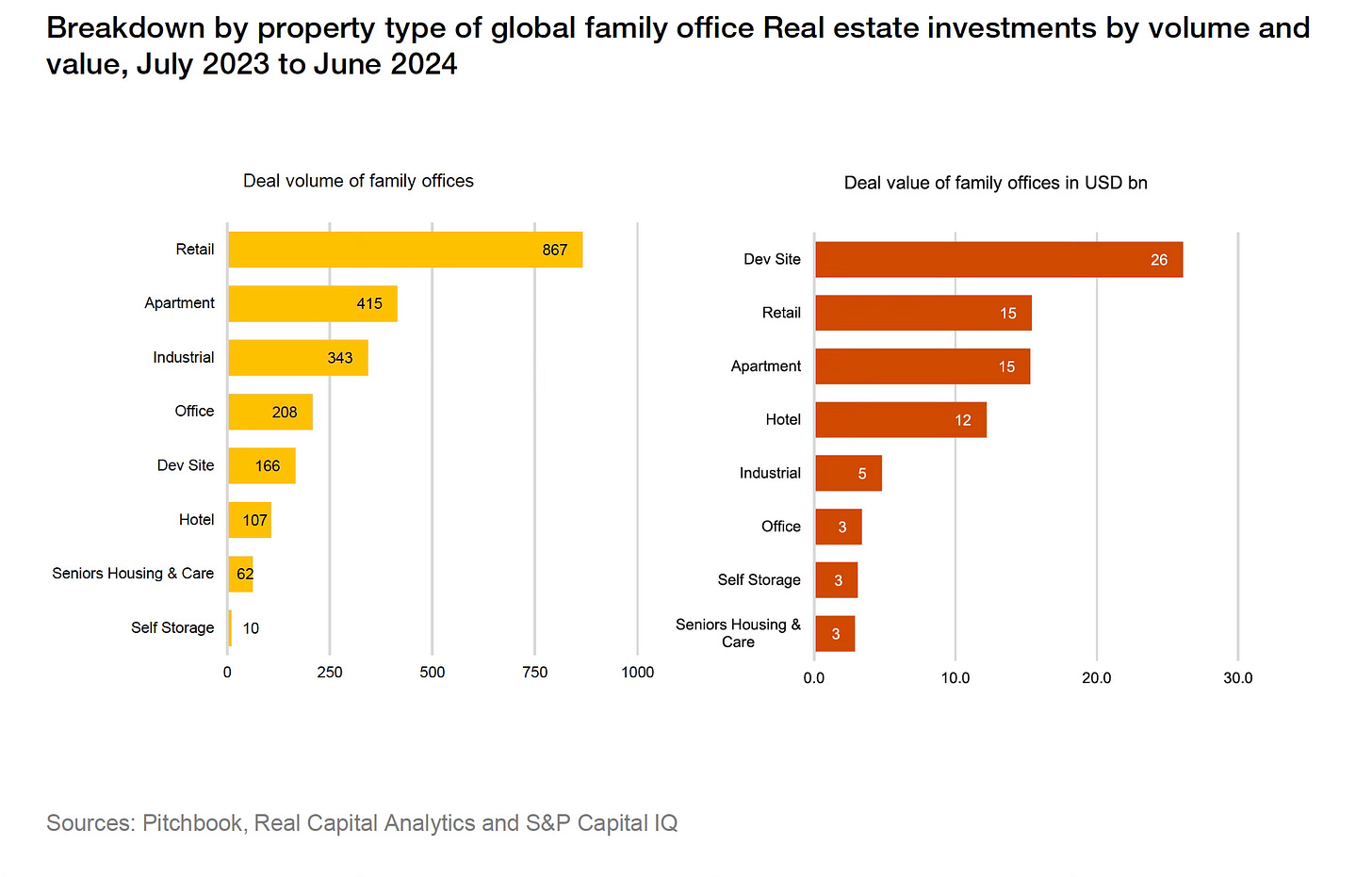

📊 Family Offices Want Development Sites

Family offices have been allocating capital to Retail, Apartments, Industrial, and Future Development Sites.

These are not passive LP commitments to blind pools. This is directed capital—focused on operators who’ve earned trust and can deliver structured results.

📬 From the Field

In the past 60 days, I’ve begun working closely with two experienced family offices on distinct real estate mandates—initiatives I’m helping lead through Pugh Management.

A ground-up multifamily strategy targeting growth corridors such as Raleigh, Charlotte, and Savannah—submarkets supported by job migration and limited new supply.

A mark-to-market industrial strategy, focused on under-managed assets with upside through tenant rollover and operational improvement.

Both offices emphasized stable income, long-term appreciation, and interest in land-constrained markets where covered land plays may provide future upside.

These aren’t opportunistic swings. They’re programmatic, thesis-driven allocations, seeking long-term alignment with seasoned operators.

💡 Implications for the Second Half of 2025

Several themes are taking shape:

Track record is paramount. New strategies without demonstrated performance are facing headwinds.

Downside structuring is expected. Risk management is being evaluated before return potential.

Programmatic partnerships are preferred. Families want to build repeatable exposure with a trusted operator—not shop deals.

This isn’t about chasing alpha. It’s about building resilient, income-generating exposure to real estate—with people who’ve been tested.

🧰 For Operators: What Capital Wants

If you’re planning to raise capital in the second half of 2025, here’s what matters most:

Clear alignment through co-investment and responsible capital use

Downside protection built into the capital stack

Access to off-market or controlled pipeline opportunities

A track record of managing through both growth and volatility

A strong pro forma may open the door. Credibility and stewardship closes deals.

🗣️ Closing Thought

There’s no shortage of capital in the market right now. What’s scarce—and valued—is access to thoughtful operators with proven judgment. The second half of 2025 presents an opportunity to build deeper relationships through structure, alignment, and quiet consistency.

Cheers, John

John T. Pugh, II

Publisher, The LineUp | Host, Private Capital Perspectives

Founder, Pugh Management

P.S. If you're a private investor, family office executive, or seasoned operator, I invite you to apply to The Investor Circle—our private, highly curated community of real estate and private markets professionals. It's built for those who value trusted deal flow, aligned capital relationships, and deeper strategic conversations.

👉 Click here to learn more and request an invitation.